How Spreads Work

However, when the n column on the first table (i.e, df1) is system generated using the tally function. This method does not work. It still gives me the Error: All columns must be named. The code I used to generate the n column using tally is listed above. Looks like the spread does not recognize the n column in this case. A COVID-19 primer: How viruses work and spread Viruses are complicated, and epidemics even more so, but if you understand the basics of how a virus works and spreads, the more complicated details. How Does Point Spread Betting Work? The goal of the point spread is to even the playing field between two teams in a game. When both teams attract an equal amount of betting action, sportsbooks are able to offer higher payouts, especially with games that feature lopsided opponents.

One of the main methods for classifying options spreads is based on the capital outlay involved. In this respect, there are basically two types; credit spreads and debit spreads. Credit spreads are named appropriately because you actually receive credit at the initial point of transacting, usually in the form of cash into your trading account. They can play an important part in your trading strategy, depending of course on what strategies you are actually using.

On this page we provide further detail on them, covering the following topics:

- A spread of minus-seven (-7) means that a is favored to win the game by a touchdown (technically, a touchdown and the extra point). A team favored by -7 must win the game by eight or more points to win the bet. If the team wins by seven, the result is a “push” and the bet is refunded.

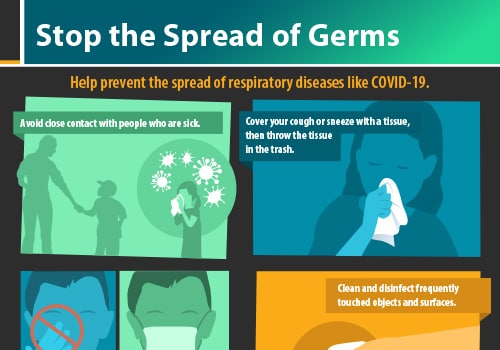

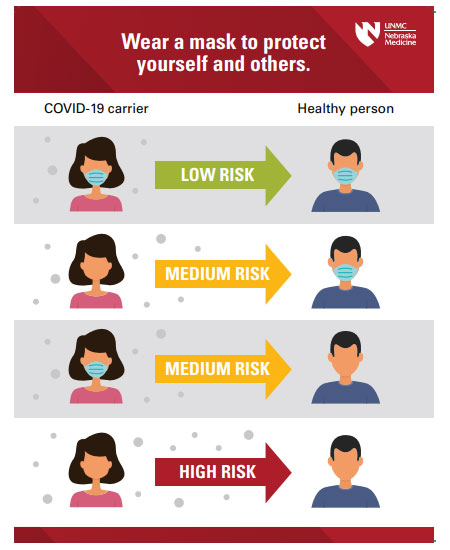

- Work from home if you can. 'How it Spreads,' 'Preventing the Spread of Coronavirus Disease 2019 in Homes and Residential Communities,' “Recommendation Regarding the Use of Cloth Face.

- How Credit Spreads are Created

- Example of a Credit Spread

- Using Credit Spreads

- Types of Credit Spreads

- Summary of Advantages & Disadvantages

How Credit Spreads Are Created

These are created by placing two separate orders on options contracts related to the same underlying security. First, you would use a sell to open order to take a short position on a contract by writing it. By writing and selling a contract, or contracts, you receive the sale price as a credit to your trading account.

You would then use some of those funds to buy cheaper contracts on the same underlying security using a buy to open order. Assuming your investment in the options you buy is less than the money you receive for those that you sell then you have a positive net position at that point, thus creating a credit spread.

Example of a Credit Spread

A common way to create a credit spread is to write options contracts that are either in the money or at the money, and then buy cheaper contracts on the same security that are out of the money. For example if you wrote 100 in the money contracts that were trading at $1.50 and bought 100 at the money contracts, on the same security, that were trading at $1.00, then you would receive $150 for writing the contracts and reinvest only $100 into buying contracts. This would give you a cash positive position of $50.

Using Credit Spreads

A credit spread basically consists of combining a short position on options which are in the money or at the money together with a long position on options that are out of the money. By using some of the funds received from taking the short position on adopting the opposing long position, you are limiting the risk you are exposed to.

Taking the short position would obviously come with a margin requirement, and by creating a credit spread you can reduce that requirement; due to the fact that the risk element is at least partially offset by the long position. If you are not familiar with how margin is used in options trading then please visit our page which explains the subject in detail here.

For example, if you wrote calls on a particular stock then you would be exposed to the risk of that stock going up in value, above the strike price. You would be obliged to sell the holder of those contracts the underlying stock at the strike price if they chose to exercise.

If you had written those contracts without owning the underlying stock, known as a naked write, then you would have to buy the stock at the higher trading price before selling them to the holder at a loss. However, if you also owned calls contracts on that stock, then you would be able to exercise and buy the stock at the strike price contained in those contracts.

Therefore, in very simple terms, the risk you are exposed to is limited to the difference between the strike price in the options you have written and the strike price in the ones you have bought. In the above example, your loss on the ones you have written increases the higher the underlying stock rises. However, your gain on the ones you have bought also increases at the same rate. This is much less risky than a simple naked write position, where your losses are theoretically unlimited.

As you can see, credit spreads are a useful tool for limiting risk while still being able to profit. By writing calls and buying calls to create a credit spread, you will usually make a profit if the underlying security falls in price or stays fairly stable. Depending on the exact features of the options involved, you may even make a profit if the price of the security goes up by just a small amount.

As outlined above, your risks are limited if the security does rise in price so there are clear advantages of using credit spreads. As well as the risks being limited, so are the profits. The maximum profit you can make is basically the money you receive for writing the options you sell minus the cost of the ones you buy.

Because it's possible to make profits spreads regardless of what direct the price of an underlying security moves in, these spreads can be used in a number of trading strategies, including multi-directional strategies. As a general rule, they are used when small moves in the price of the underlying security are expected.

Types of Credit Spreads

There are a number of different types of credit spreads that you can use in options trading, depending on what your strategies are and what market movements you are expecting. In our section on Options Trading Strategies you will find more details of how they are used. The following are the commonly used.

Summary of Advantages & Disadvantages

There are four main advantages of credit spreads. First, when you create them you will receive cash up front into your trading account. The fact that you can limit your losses is obviously beneficial, as is the fact that you can use them to gain a profit based on the underlying security moving in more than one direction. They have the advantage of requiring a lower margin requirement than naked writes.

How Spreads Work Betting

One disadvantage is that they do still require you to trade on margin, which is not something you need to do if you are just straight up buying options contracts. Also, although you are limiting your potential losses, you are limiting your profits too; this means the risk to reward ratio is not usually that favorable.